a16z 全球 AI 产品 Top100:DeepSeek 增长放缓,「中国开发,出海全球」成为新常态

分类:AI资讯 浏览量:355

AI 总结:

a16z 2025年8月发布第五版Top 100生成式AI消费级应用,含网页(ChatGPT榜首,谷歌多产品上榜)与移动(ChatGPT第一)各50款,生态趋稳。亮点有Grok、Meta发力,中国企业(夸克、豆包等)表现突出,Vibe coding用户留存佳,14家成“全明星”,数据源自Similarweb等,不构成投资建议。

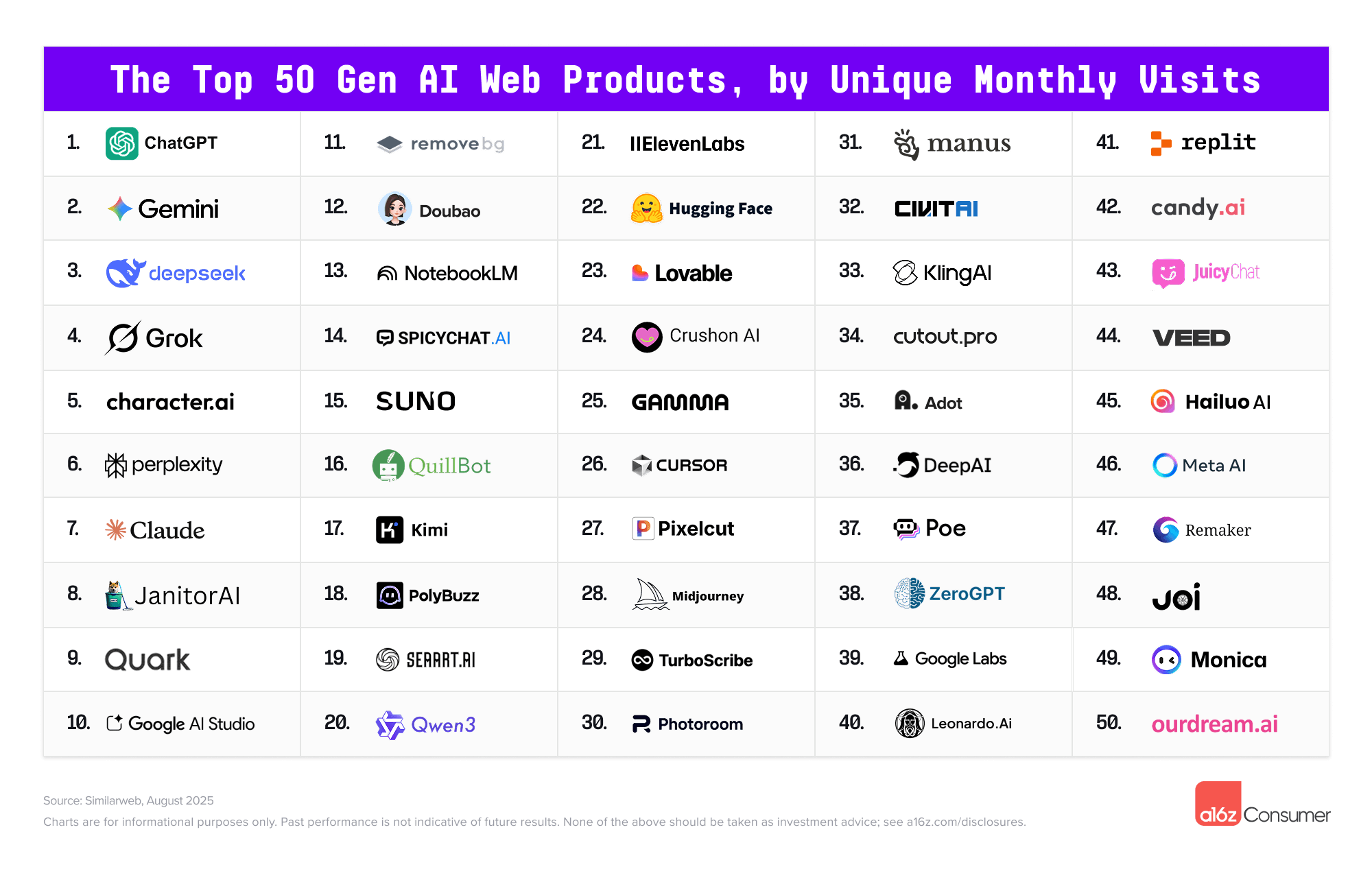

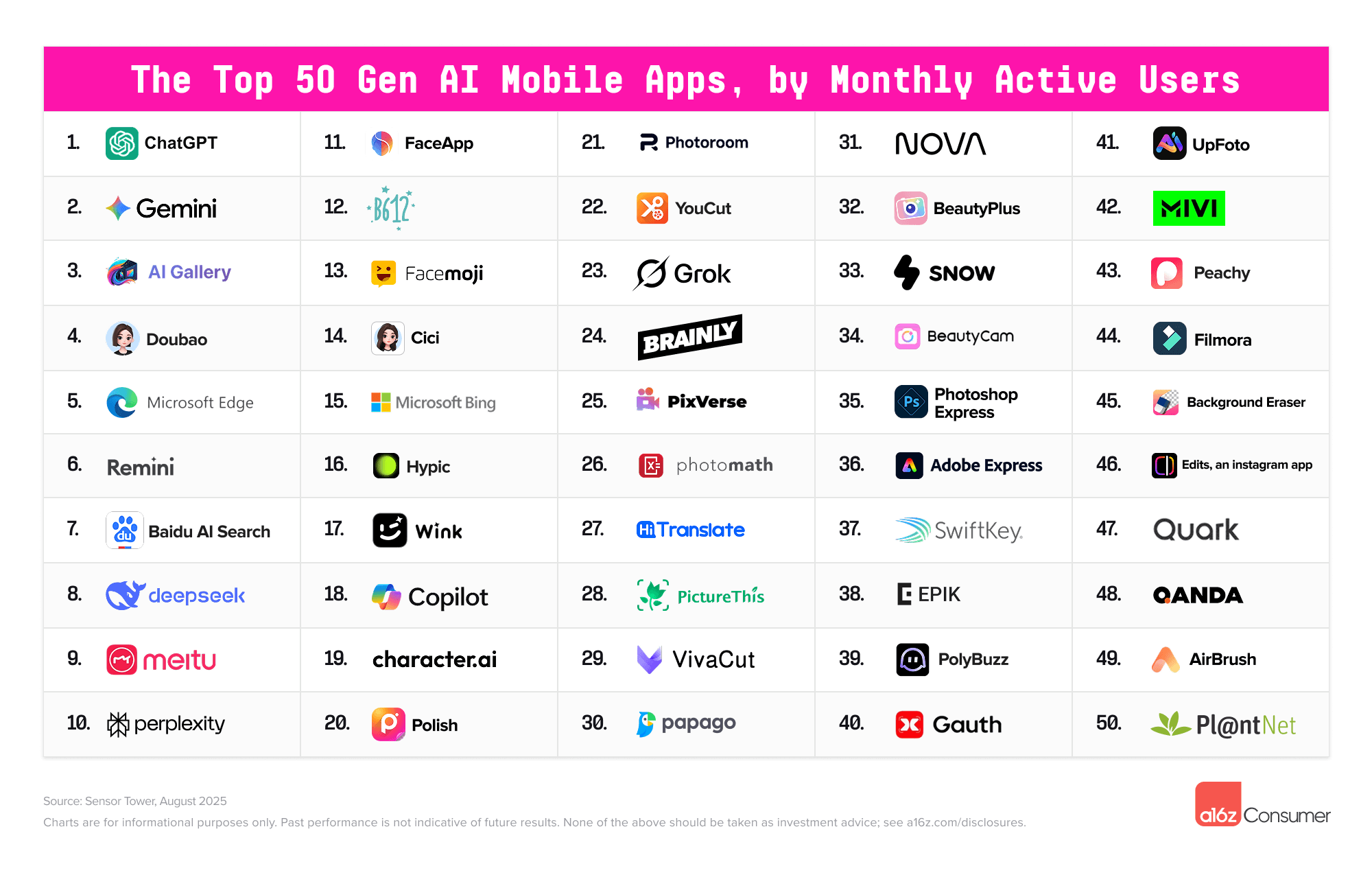

This is the fifth edition of our Top 100 Gen AI Consumer Apps which reflects two and a half years of data on how everyday AI usage is evolving.

这是我们第五版的百强新一代人工智能消费者应用程序,反映了两年半以来日常人工智能使用情况的演变数据。

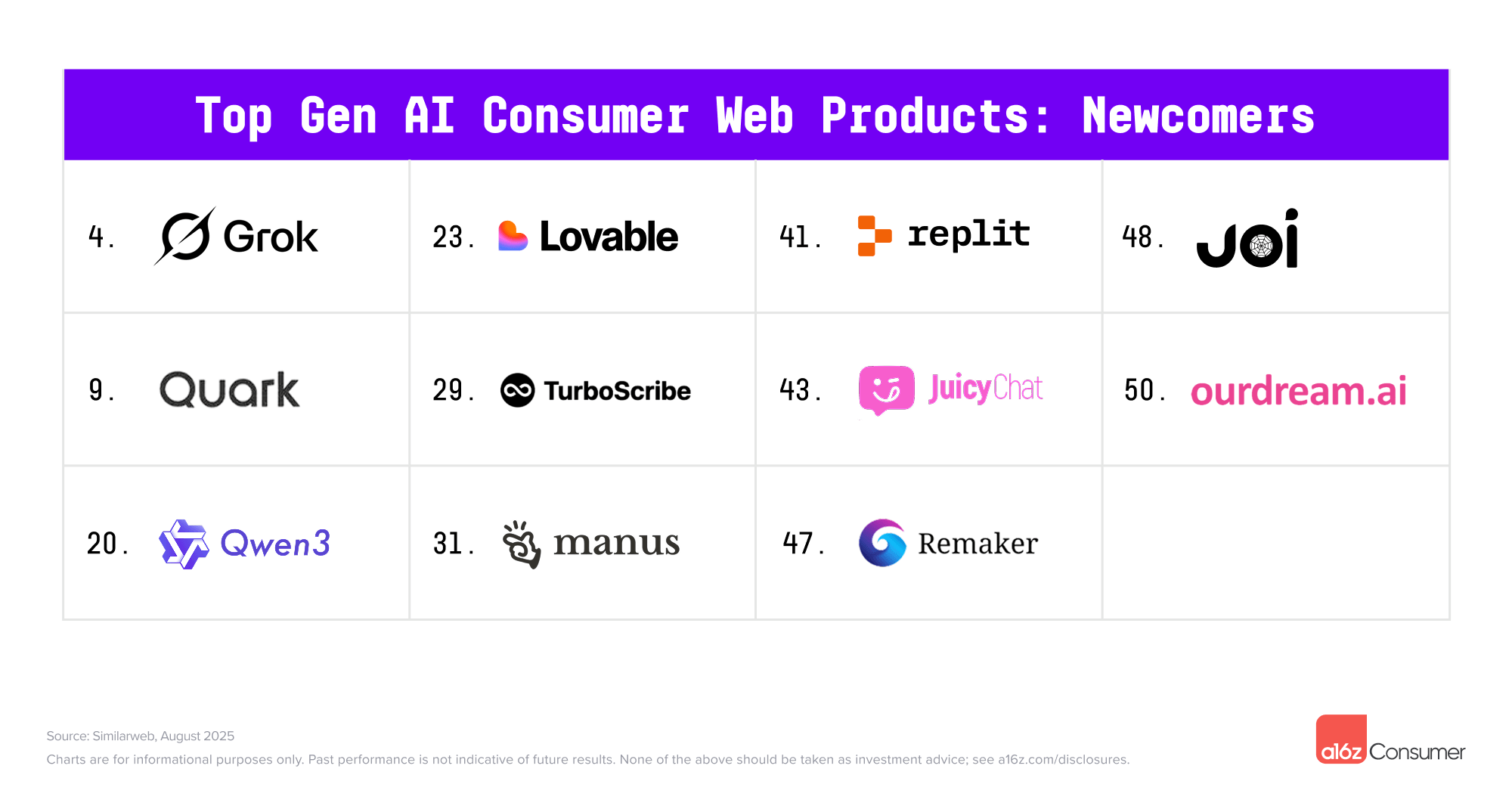

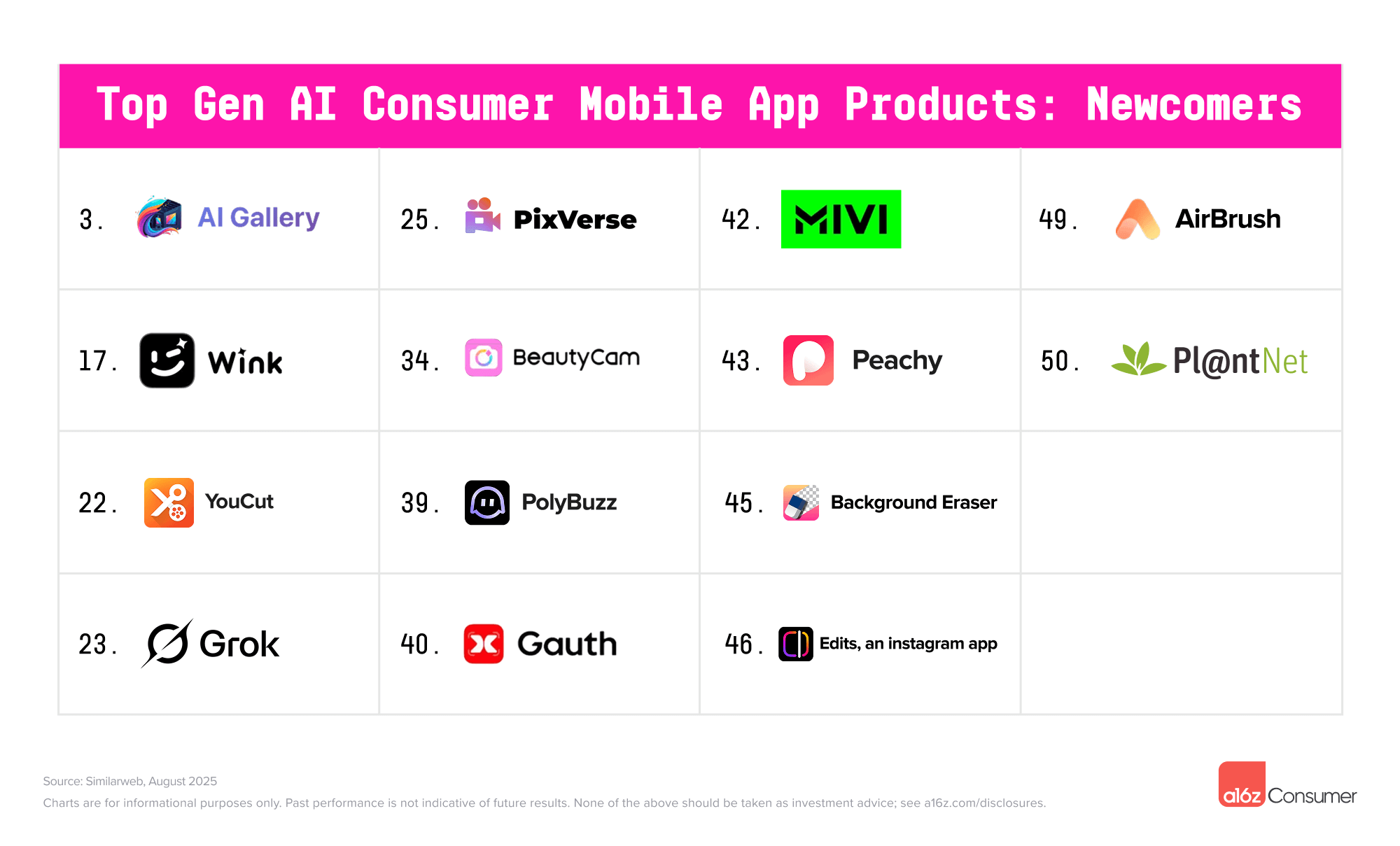

The biggest takeaway from this edition of the list? The ecosystem is starting to stabilize, with 11 new names on the web list driven by traffic increases.* This compares with 17 newcomers in our March 2025 ranking. The mobile list has significantly more newcomers (14), as the App Stores have cracked down on “ChatGPT copycats”—opening up room for more original mobile apps.

本期榜单最大的亮点是什么?生态系统正开始趋于稳定,受流量增长推动,网页版榜单新增了 11 个应用。* 相比之下,我们 2025 年 3 月的榜单中共有 17 个新上榜应用 。移动版榜单的新上榜应用数量显著增多(14 个),这得益于应用商店严厉打击“ChatGPT 抄袭者”,为更多原创移动应用腾出了空间。

*Note – Google has four new products on the list as they have further separated the domains, allowing us to track their AI initiatives individually for the first time! This yields 15 newcomers in total, but these four would have ranked on prior lists if they had been measurable.

*注:谷歌将四款新产品上榜,因为他们进一步细分了领域,这让我们首次能够单独追踪他们的人工智能计划!这样一来,新上榜的产品一共有 15 款,但如果它们可以衡量的话,这四款产品在之前的榜单上应该也能排名。

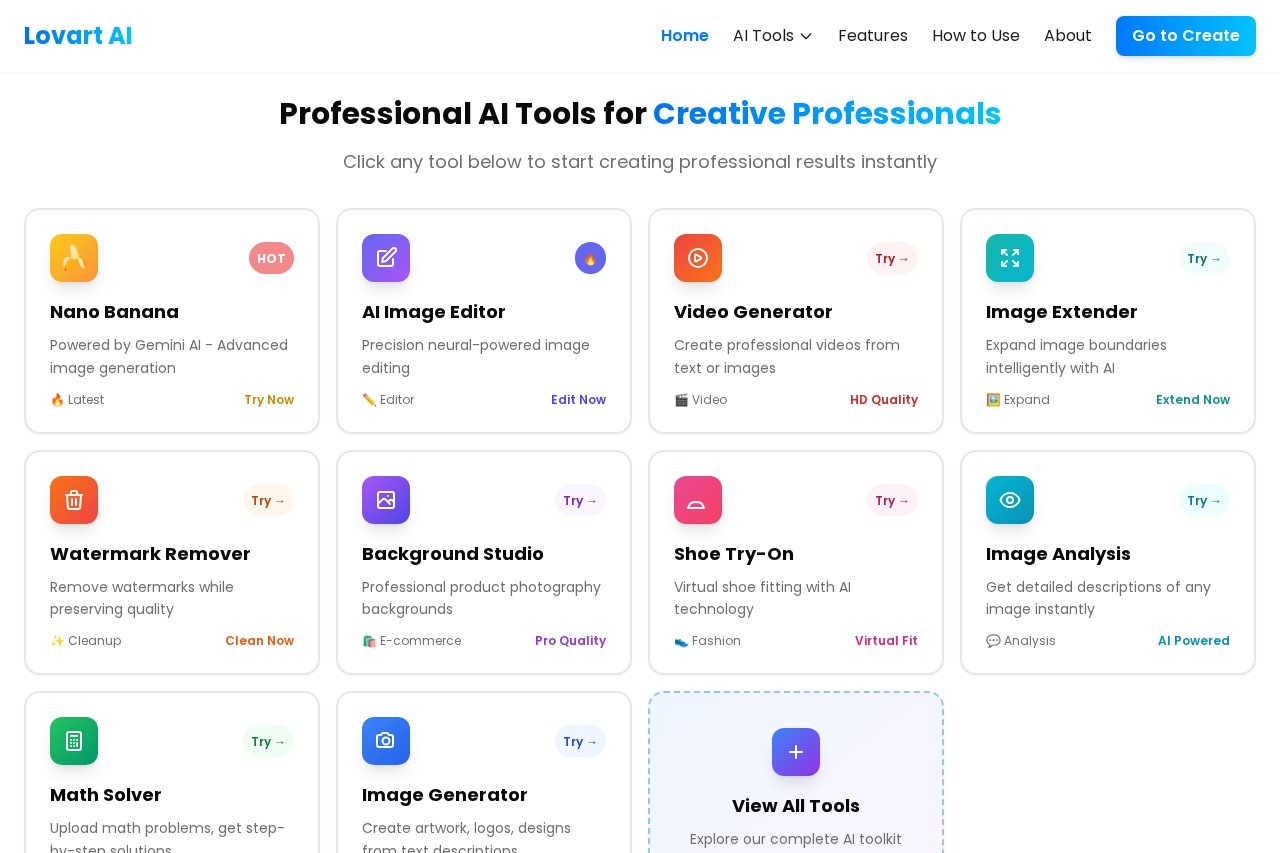

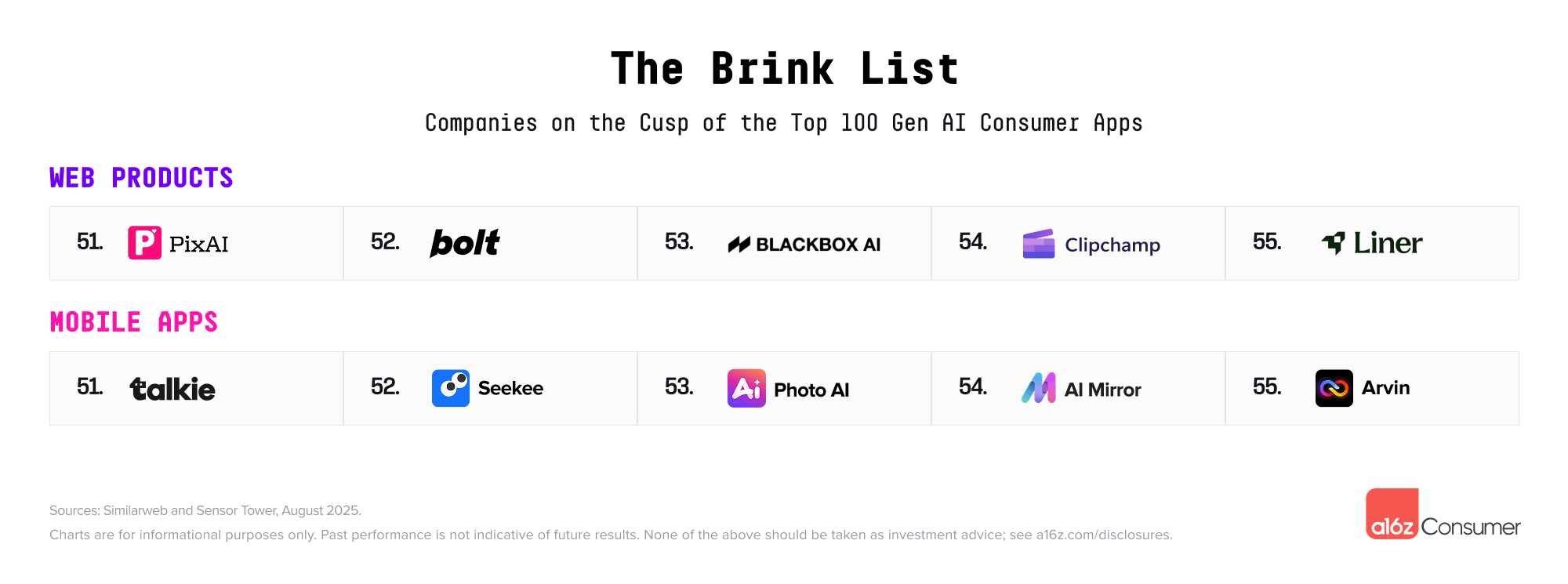

For the second time, we’re also publishing the “Brink List”: the next 10 companies (five on web, five on mobile) that just missed the cut-off. From last edition’s web Brink List, one company moved into the top 100—Lovable, jumping to an impressive #22 in the rankings! This jump highlights the broader rise of AI-powered app generation.

我们还第二次发布了“边缘榜单”(Brink List):列出了接下来 10 家未能入围的公司(其中 5 家在网页端,5 家在移动端)。在上一期的网页版 Brink List 中,有一家公司进入了前 100 名——Lovable,排名跃升至令人印象深刻的第 22 位!这一跃升凸显了人工智能驱动的应用生成正在更广泛地兴起 。

From the last mobile Brink List, two companies—PolyBuzz and Pixverse—moved into the core rankings.

从上一期移动版 Brink List 来看,PolyBuzz 和 Pixverse 两家公司进入了核心排名。

A methodology note: the lists are a ranking of the top 50 AI-first web products (by unique monthly visits, per Similarweb) and top 50 AI-first mobile apps (by monthly active users, per Sensor Tower). Products that have added significant generative AI features but are not AI-native, such as Canva and Notion, are not included here.

方法说明:本榜单排名前 50 位 AI 优先的网页产品(根据 Similarweb 的月独立访问量)和前 50 位 AI 优先的移动应用(根据 Sensor Tower 的月活跃用户量)。添加了重要生成式 AI 功能但并非 AI 原生的产品(例如 Canva 和 Notion)不包含在内。

Here are some of our other top takeaways:

以下是我们的其他一些重要结论:

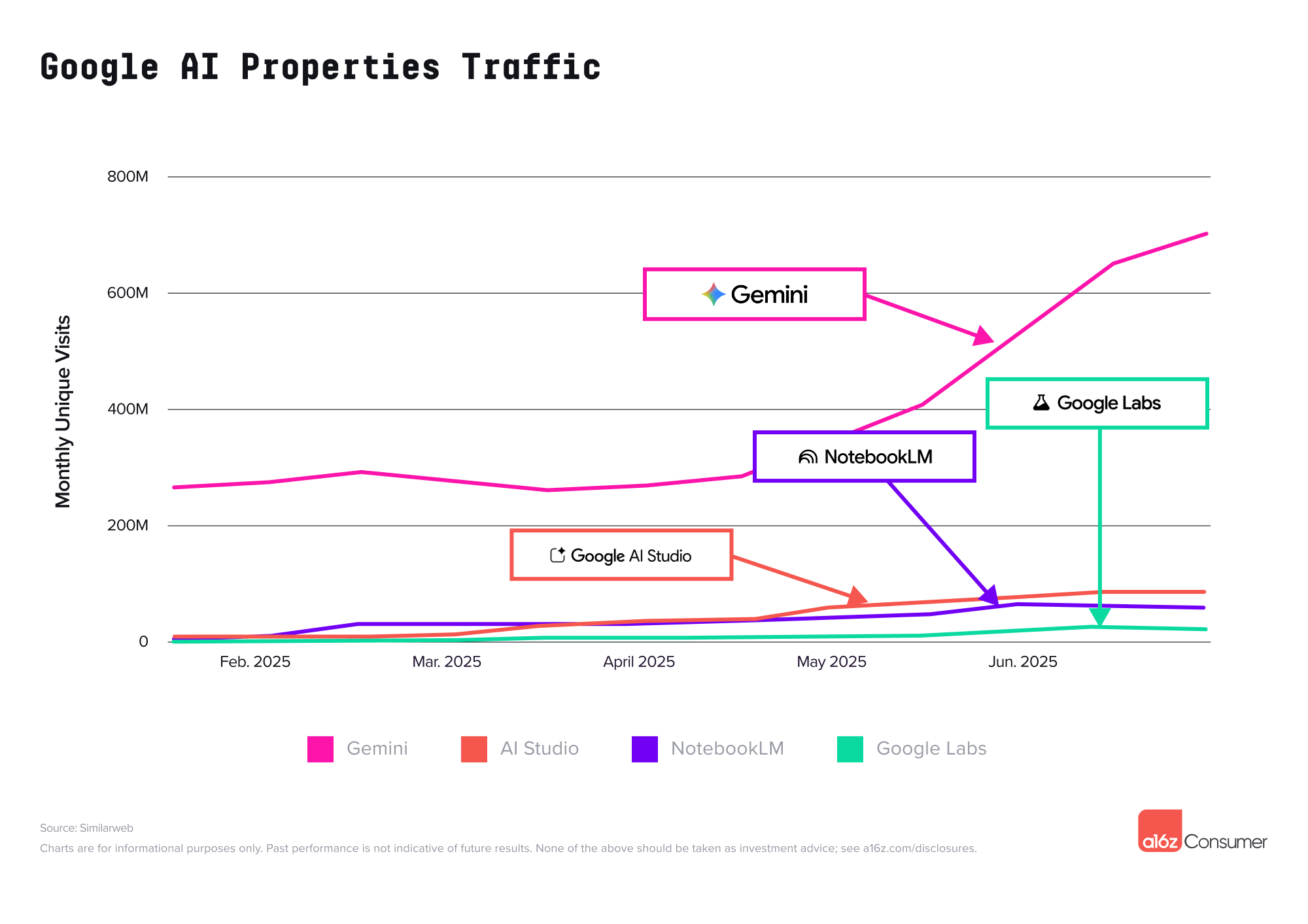

Google saw four entrants on the web list—for the first time, we are able to rank their traffic and include them each independently. The company’s general LLM assistant, Gemini, came in second place behind ChatGPT, with approximately 12% of ChatGPT’s visits on web.

Google 的网页版榜单上有四家公司入围——这是我们首次能够对它们的流量进行排名,并将它们分别单独列出。该公司的法学硕士助理 Gemini 位居 ChatGPT 之后,排名第二,约占 ChatGPT 网页版访问量的 12%。

What other Google products made the list? AI Studio debuted in the top 10. The site, which is developer-oriented, hosts a sandbox to start building with Gemini models, including multimodal models (ex. talk and stream with Gemini Live).

其他 Google 产品也榜上有名吗?AI Studio 首次亮相就跻身前十。该网站面向开发者,提供了一个沙盒,开发者可以使用 Gemini 模型进行构建,包括多模态模型(例如,使用 Gemini Live 进行对话和直播)。

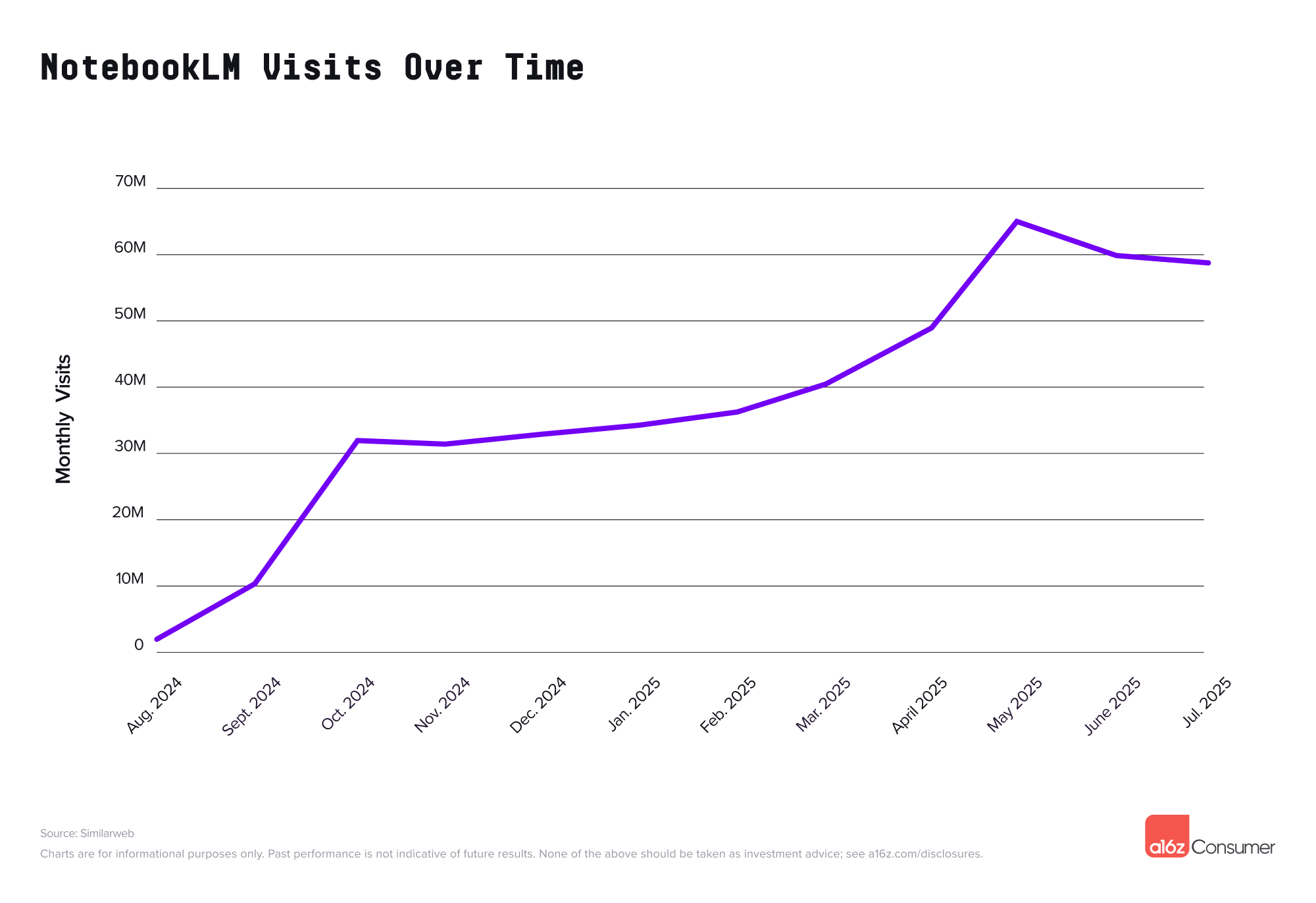

AI Studio was followed by NotebookLM at #13, now hosted as an independent website after debuting as part of Google Labs. NotebookLM first went viral nearly a year ago and has grown steadily since, with only a slight dip over the summer (likely when academic users temporarily churn).

紧随 AI Studio 之后的是 NotebookLM,排名第 13 位。NotebookLM 最初是 Google 实验室的一部分,现在已独立运营。NotebookLM 于近一年前首次走红,此后一直稳步增长,仅在夏季出现过轻微下滑(可能是因为学术用户暂时流失)。

Google Labs, the consumer-facing home for AI experiments at Google, came in at #39 on the list. Labs hosts Flow, where users can try video model Veo 3, as well as a variety of other apps, including Doppl (clothing try-on), Portraits (AI coaches), and Project Mariner (agentic browser). Google Labs’s traffic spiked more than 13% following Veo 3’s launch in May 2025, its largest one-month climb over the past year.

谷歌实验室是谷歌面向消费者的人工智能实验中心,位列榜单第 39 位。实验室托管着 Flow,用户可以在其中试用视频模型 Veo 3,以及各种其他应用,包括 Doppl(服装试穿)、Portraits(人工智能教练)和 Project Mariner(代理浏览器)。自 2025 年 5 月 Veo 3 发布以来,谷歌实验室的流量飙升超过 13%,创下过去一年的最大单月增幅。

On mobile, Gemini ranks #2 behind ChatGPT – but by a much narrower margin, with nearly half as many monthly active users (MAUs). Gemini sees particularly strong usage on Android devices, with nearly 90% of their MAU base represented here, compared to 60% of users on Android for ChatGPT.

在移动端,Gemini 排名第二,仅次于 ChatGPT,但差距较小,月活跃用户 (MAU) 数量几乎是 ChatGPT 的一半。Gemini 在安卓设备上的使用率尤其高,其近 90% 的月活跃用户都来自安卓设备,而 ChatGPT 的安卓用户比例仅为 60%。

In the battle of the general LLM assistants, ChatGPT still leads, but Google, Grok, and Meta are narrowing the gap.

在通用 LLM 助手的争夺中,ChatGPT 仍然领先,但 Google、Grok 和 Meta 正在缩小差距。

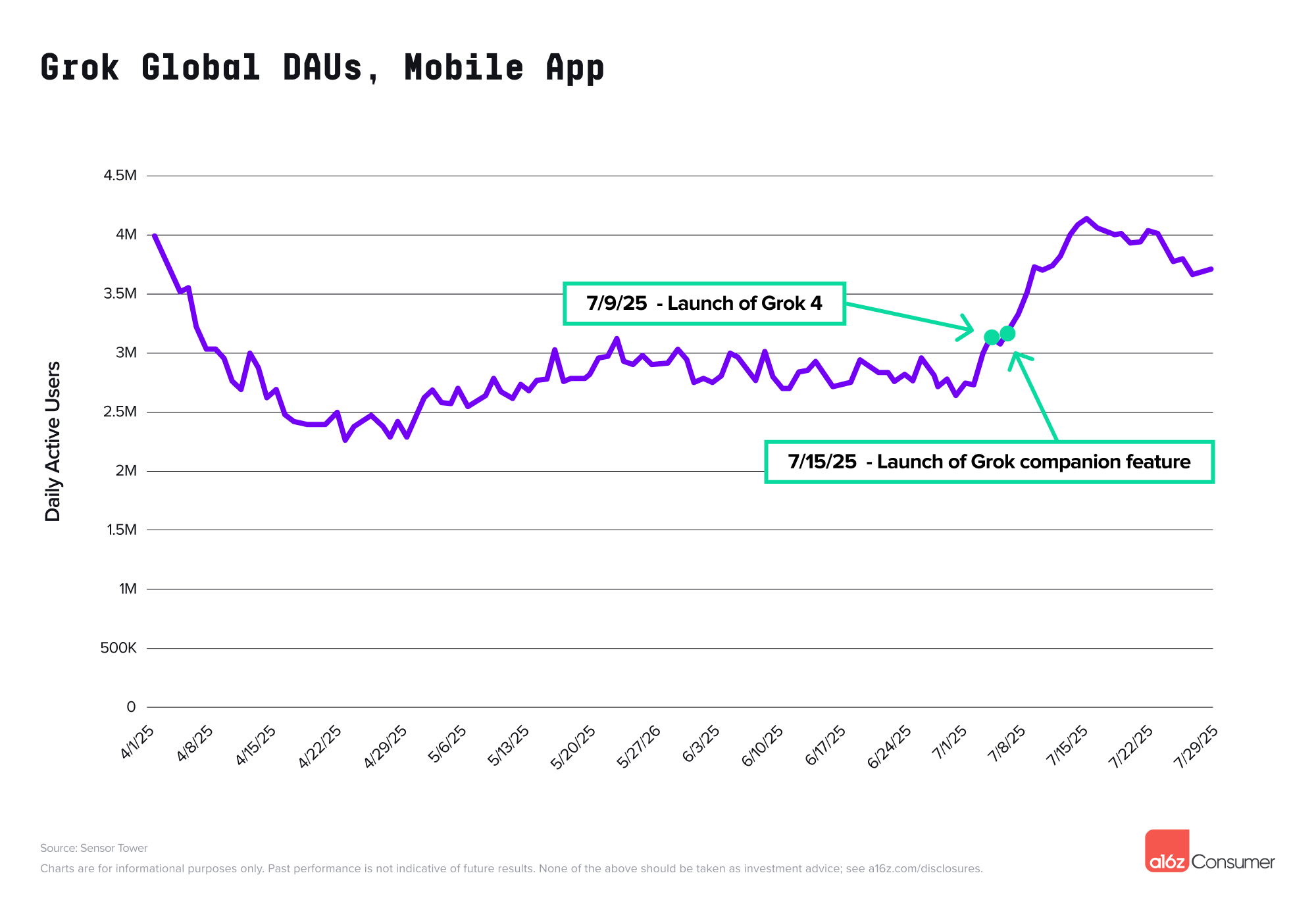

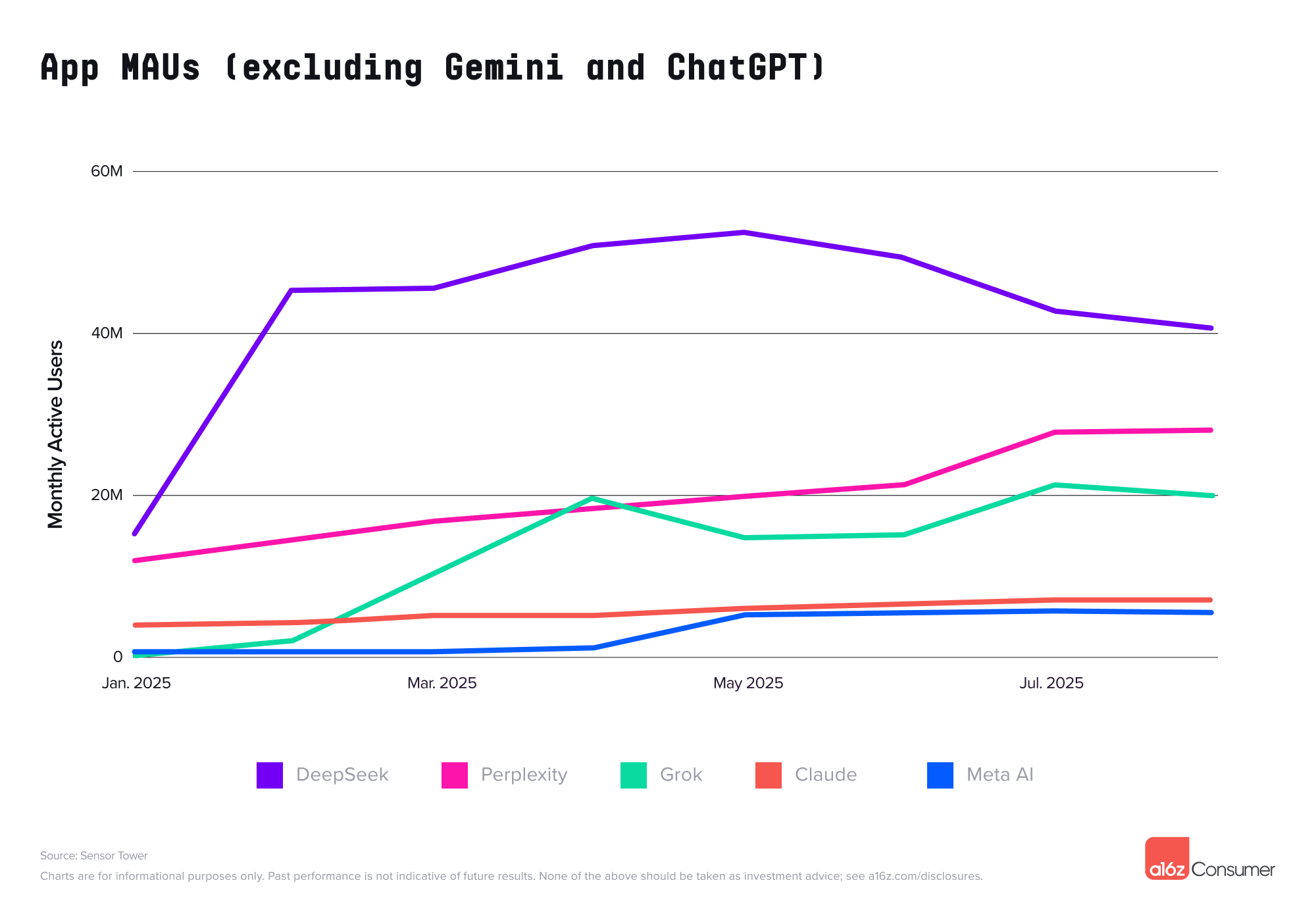

X’s (formerly Twitter) assistant Grok ranked fourth on web and #23 on mobile. The company’s jump on mobile has been particularly striking, going from a “cold start” with no app at the end of 2024 to upwards of 20M monthly active users now.

X(前身为 Twitter)的助手 Grok 在网页端排名第四,在移动端排名第 23。该公司在移动端的飞速发展尤为引人注目,从 2024 年底没有应用程序的“冷启动”发展到如今每月活跃用户超过 2000 万。

Grok saw a particularly large bump in mobile usage in July 2025, climbing nearly 40% with the release of new model Grok 4 (with superior reasoning, real-time search, and tool integration) on July 9. This was followed by the introduction of AI companion avatars on July 14. At launch, anime avatar Ani (which includes NSFW options) was particularly popular.

2025 年 7 月,Grok 在移动端的使用量出现了特别大的增长,随着 7 月 9 日发布新模型 Grok 4(具有卓越的推理、实时搜索和工具集成功能),其增长了近 40%。随后,在 7 月 14 日推出了 AI 伴侣头像。在发布时,动漫头像 Ani(包含 NSFW 选项)特别受欢迎。

Meta has seen more muted growth (thus far) for its efforts. General assistant Meta AI ranked #46 on web, and missed the cutoff for the mobile list. Meta AI debuted in late May 2025 but saw a much slower ramp than Grok, especially after a June 2025 incident when users realized some posts were appearing on a public feed.

Meta 的努力迄今为止增长较为平缓。通用助手 Meta AI 在网页端排名第 46 位,未能进入移动端榜单。Meta AI 于 2025 年 5 月下旬首次亮相,但增长速度远慢于 Grok,尤其是在 2025 年 6 月发生一起事件后,当时用户发现一些帖子出现在了公共信息流中。

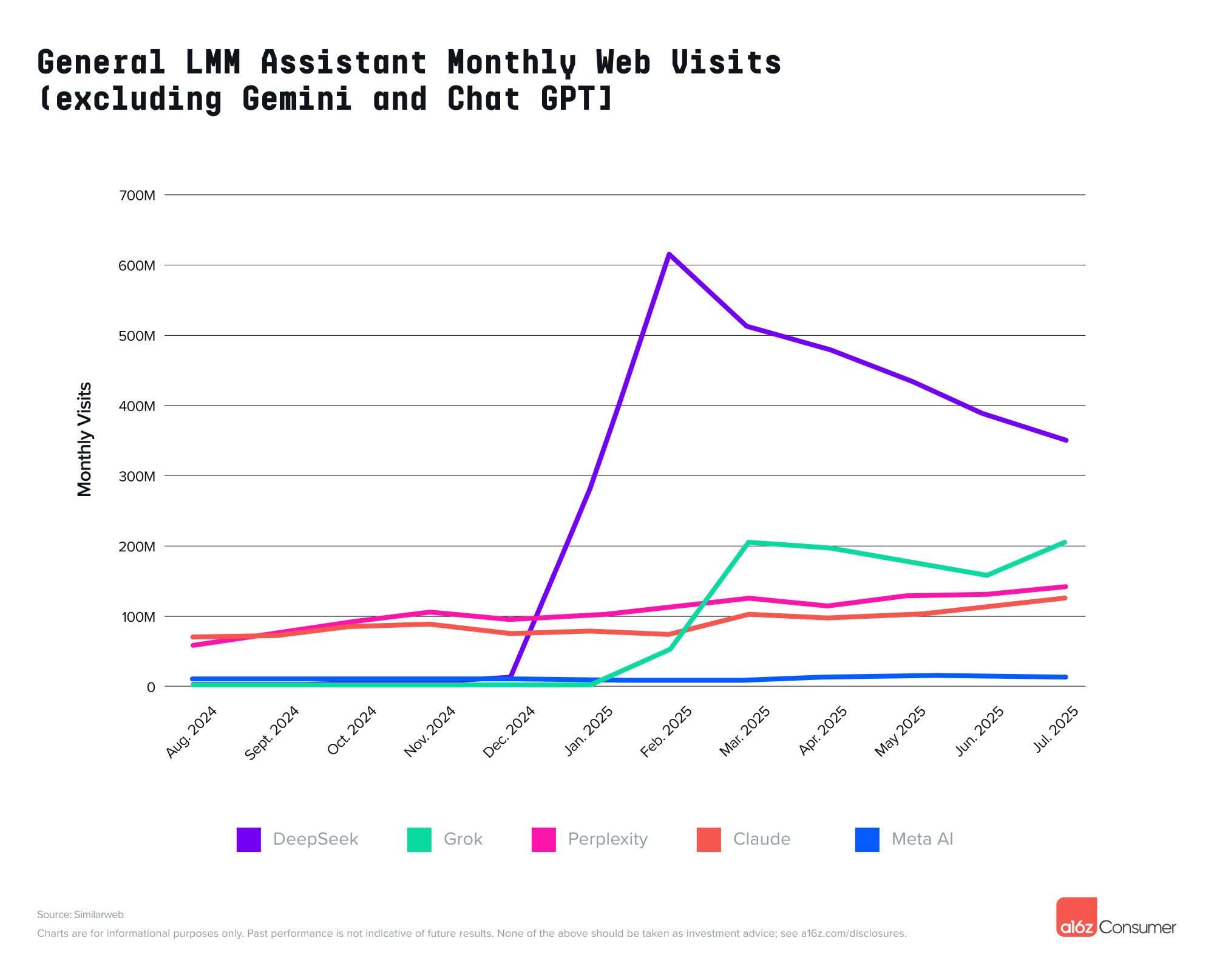

Elsewhere in the general LLM assistant battle, DeepSeek and Claude have both significantly flattened on mobile, with DeepSeek falling off its peak by 22%. Perplexity has continued to show strong growth alongside Grok.

在法学硕士助手的竞争中,DeepSeek 和 Claude 在移动端的表现均显著平缓,DeepSeek 的峰值下滑了 22%。Perplexity 和 Grok 则继续保持强劲增长势头。

On web, DeepSeek saw an even more dramatic dropoff, down more than 40% from its peak in February 2025, while Perplexity and Claude have continued to grow.

在网络上,DeepSeek 的下降幅度更为显著,较 2025 年 2 月的峰值下降了 40% 以上,而 Perplexity 和 Claude 则继续增长。

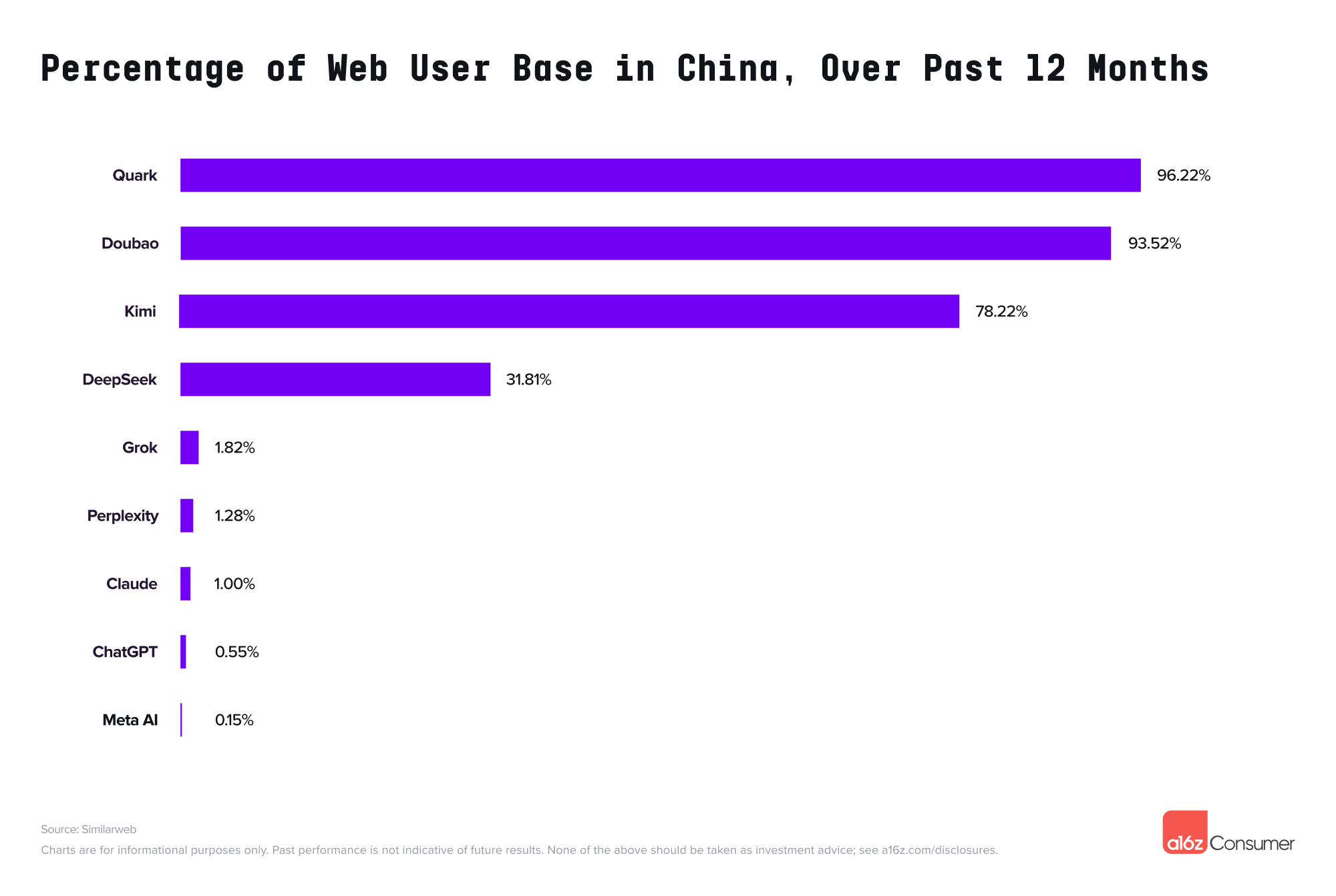

On the web list, three companies that primarily serve users in China rank in the top 20. Each has a Chinese-language website and more than 75% of its traffic coming from China. This includes #9 Quark, Alibaba’s “all-in-one” AI assistant (which also ranks #47 on the mobile list), #12 Doubao, Bytedance’s general LLM product (ranked #4 on mobile), and #17 Kimi, a chatbot from startup Moonshot AI.

在网页端榜单中,有三家主要服务于中国用户的公司跻身前 20 名。每家公司都拥有中文网站,超过 75%的流量来自中国。这三家公司分别是:排名第 9 的夸克(Quark),阿里巴巴的“一体化”人工智能助手(在移动端榜单中也排名第 47 位);排名第 12 的豆宝(Doubao),字节跳动的通用法学硕士产品(在移动端榜单中排名第 4);以及排名第 17 的 Kimi(Kimi),这是初创公司 Moonshot AI 的聊天机器人。

Why are these products appearing on the list? China is the world’s second largest country (by population), and direct access to many non-Chinese developed general LLM assistants—such as ChatGPT, Perplexity, and Claude—is either blocked or limited. AI providers that want to operate in China have to register and obtain a license, which requires hosting data onshore and complying with censorship and content moderation rules.

这些产品为何会出现在名单上?中国是世界第二大人口大国,许多非中国开发的通用法学硕士(LLM)助手(例如 ChatGPT、Perplexity 和 Claude)的直接访问要么被屏蔽,要么受到限制。想要在中国运营的人工智能提供商必须注册并获得许可证,这就要求其在境内托管数据,并遵守审查和内容审核规则。

Some users still access unregistered products via VPNs, or are able to access products from within China via corporate or academic network gateways—which is why traffic for products like ChatGPT in China is non-zero.

一些用户仍然通过 VPN 访问未注册的产品,或者能够通过企业或学术网络网关从中国境内访问产品——这就是为什么 ChatGPT 等产品在中国的流量不为零的原因。

A significant percentage of the web list was also developed in China, and now “exported” globally—with the vast majority of usage in other countries. Some of these tools are even blocked in China. Public data suggests seven additional companies fit this criteria—including Deepseek, Hailuo and Kling (video generation models), SeaArt (image generation), Cutout Pro (image editing), and Manus and Monica (prosumer / productivity).

该网络列表中的很大一部分工具也由中国开发,如今已“出口”到全球——其中绝大多数在其他国家使用。其中一些工具甚至在中国被屏蔽。公开数据显示,另有七家公司符合这一标准——包括 Deepseek、Hailuo 和 Kling(视频生成模型)、SeaArt(图像生成)、Cutout Pro(图像编辑)以及 Manus 和 Monica(产消合一/生产力)。

Chinese video models, in particular, have tended to have an advantage over Western-developed models—both because there are more researchers focused on video in China, and there are fewer IP regulations (with likely training on copyrighted data). Veo 3 was the first U.S. model to break this trend, which is partially trained on YouTube data.

尤其是中国的视频模型,往往比西方开发的模型更具优势——这既是因为中国专注于视频的研究人员更多,也是因为知识产权法规较少(很可能需要基于受版权保护的数据进行训练)。Veo 3 是第一个打破这一趋势的美国模型,该模型部分基于 YouTube 数据进行训练。

This trend is even more striking in the mobile ranks. An estimated 22 of the 50 apps were developed in China, while only three are primarily used in China. There is particularly heavy concentration in the photo and video category, as Meitu alone produced five entries: Photo & Video Editor, BeautyPlus, BeautyCam, Wink, and Airbrush. Bytedance is also a significant player, producing Doubao and Cici (general LLM assistant), Gauth (edtech), and Hypic (photo / video editing).

这一趋势在移动领域尤为显著。据估计,50 款应用中约有 22 款由中国开发,而主要在中国使用的仅有 3 款。照片和视频类别的集中度尤其高,仅美图一项就推出了五款应用:照片和视频编辑器、美颜相机、美颜相机、眨眼相机和喷枪。字节跳动也是一个重要的参与者,旗下有豆宝和 Cici(法学硕士通用助理)、Gauth(教育科技)和 Hypic(照片/视频编辑)。

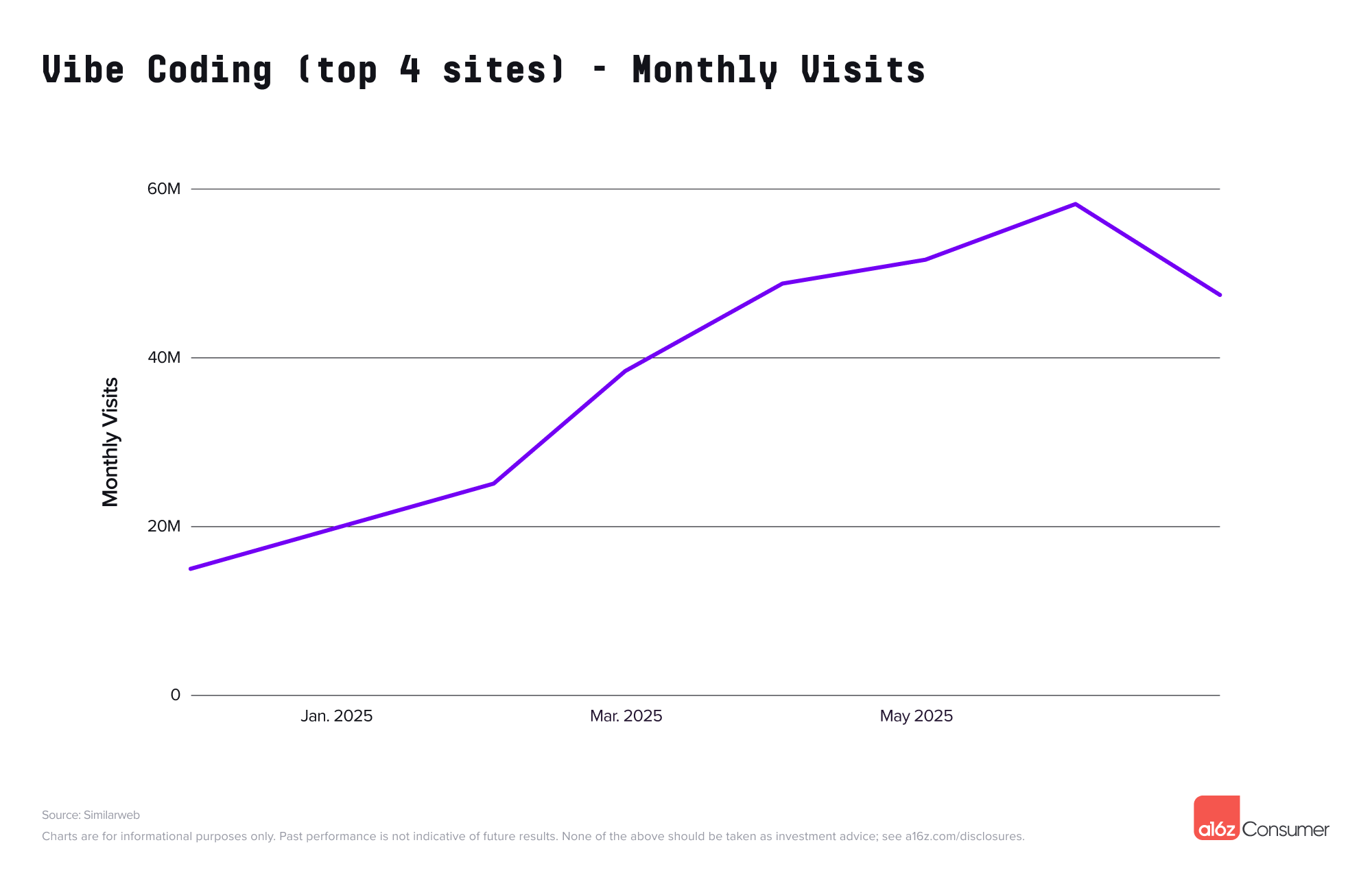

In our last ranking in March 2025, vibe coding had just begun to emerge—with only Bolt on the web list. Now, Bolt is on the Brink List (just missing the cut!), while Lovable and Replit both debuted on the main list.

在我们 2025 年 3 月的上一次排名中,氛围编码才刚刚兴起——当时只有 Bolt 出现在网络榜单上。现在,Bolt 出现在了边缘榜单(差点没入围!),而 Lovable 和 Replit 则首次出现在主榜单上。

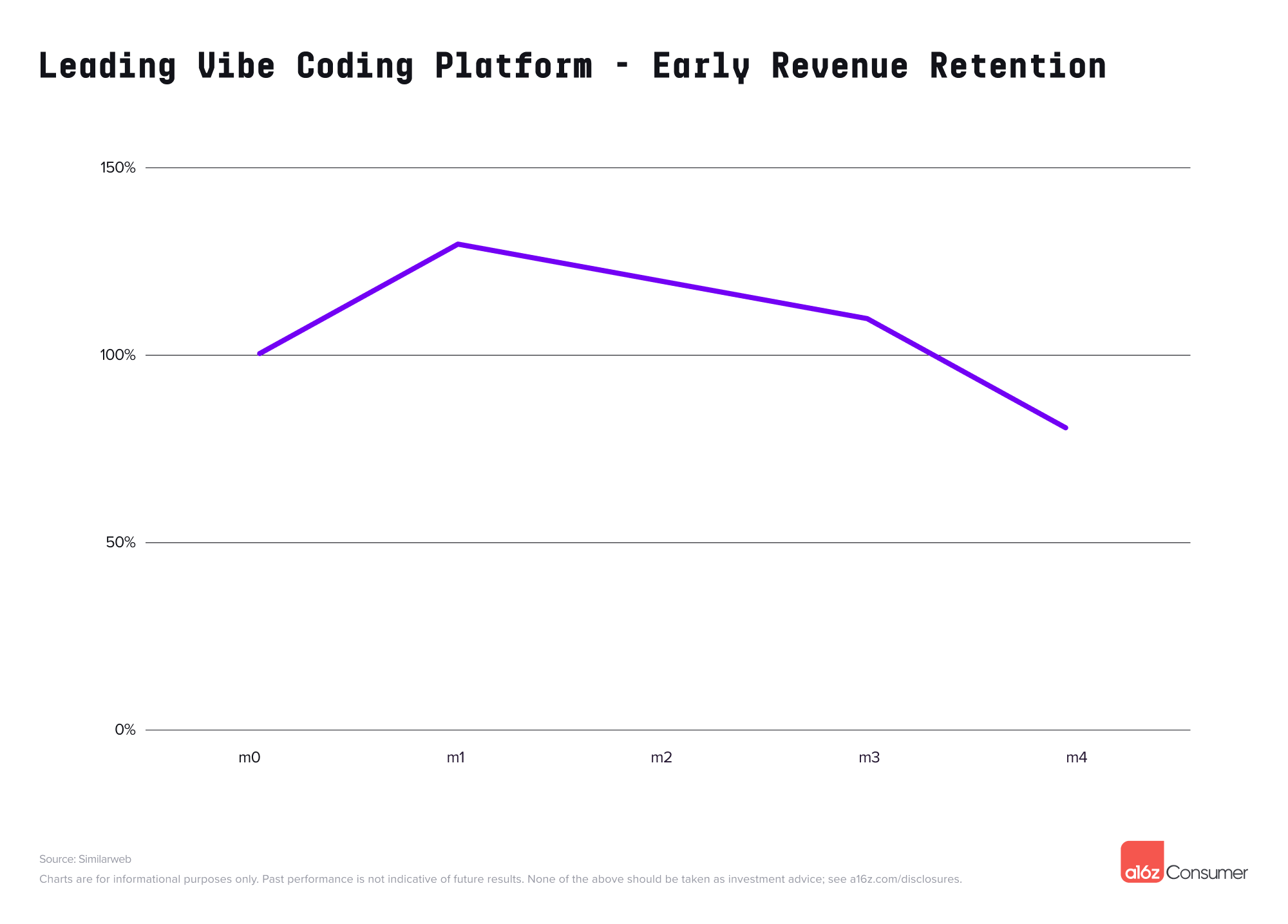

While vibe coding usage may seem transitory, early data reveals that these users stick around—or, at least enough of them do and expand their usage over time. Data from credit card panel provider Consumer Edge shows cohorts for U.S. based users of one top vibe coding platform see revenue retention upwards of 100% for several months post-signup. This means that including users who churn, cohorts are growing overall spend on a monthly basis.

虽然氛围编码的使用似乎只是昙花一现,但早期数据显示,这些用户会持续使用,或者至少有足够多的用户会持续使用,并随着时间的推移不断扩展使用范围。信用卡数据提供商 Consumer Edge 的数据显示,某顶级氛围编码平台的美国用户群组在注册后的几个月内,收入留存率高达 100% 以上。这意味着,即使算上流失用户,群组的月总支出也在增长。

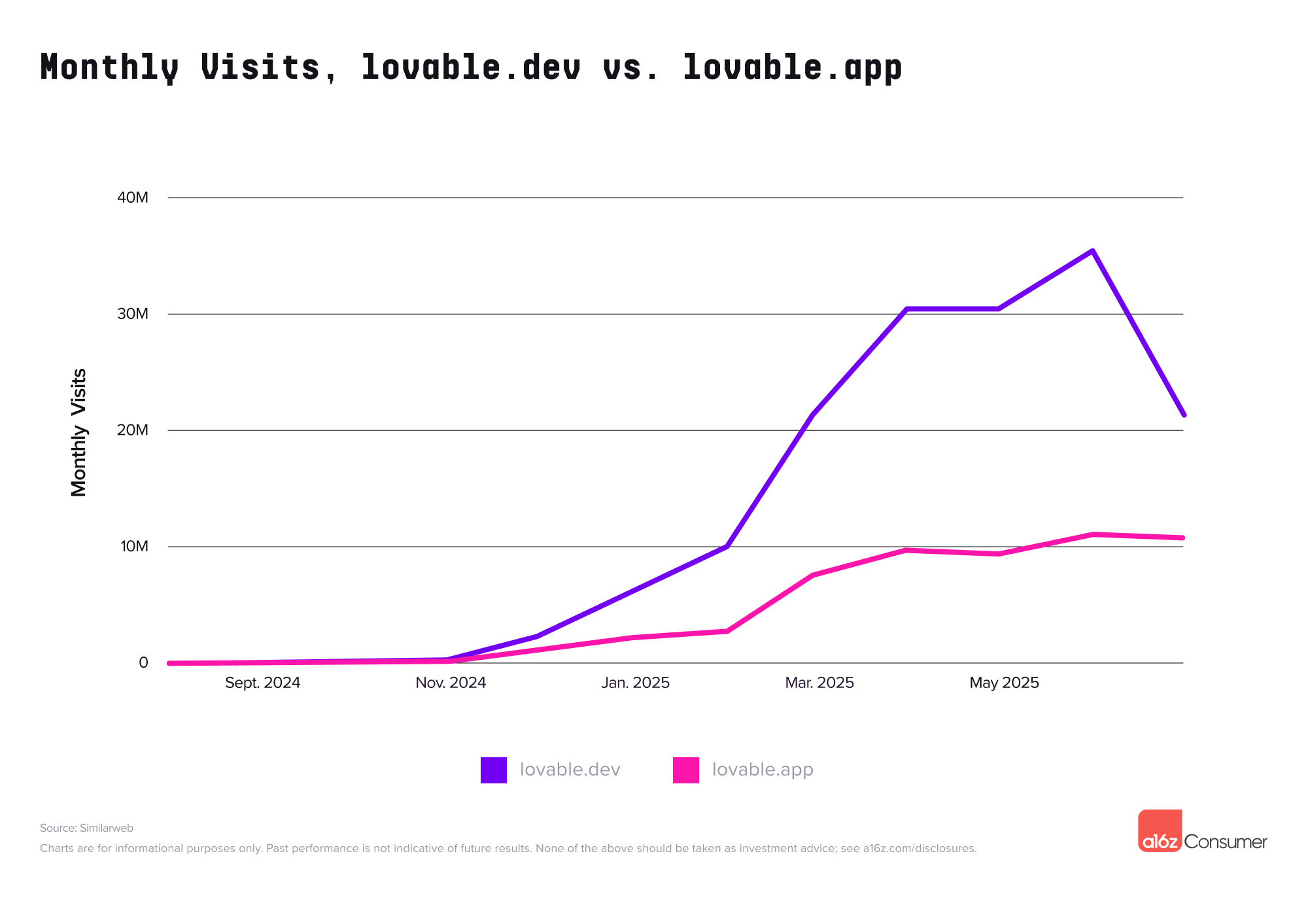

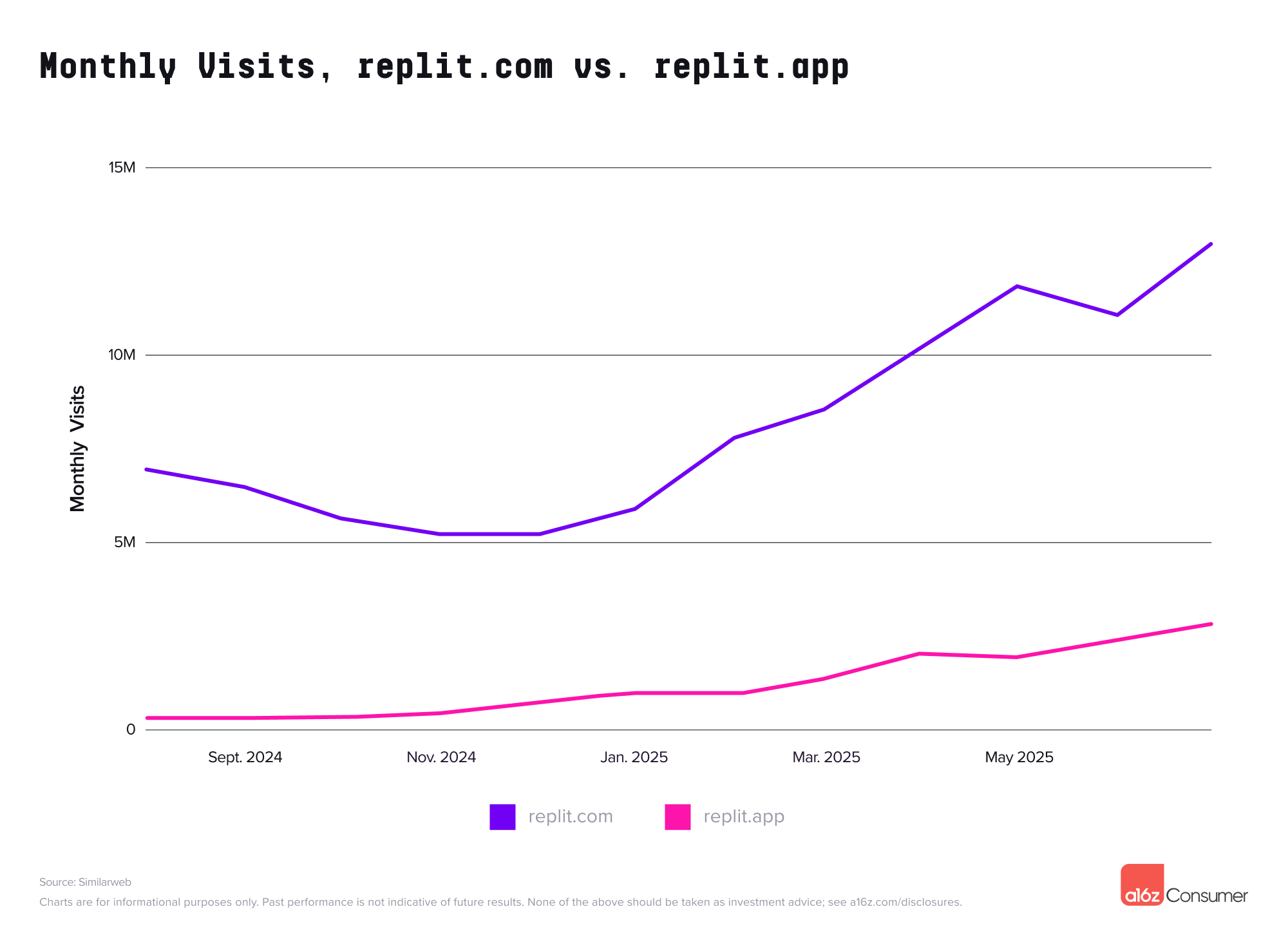

These platforms are also driving usage to other AI products. Sites built and published via Replit and via Lovable (without custom domains) appear under traffic for replit.app and lovable.app, respectively. Both have significant traffic of their own (traffic to lovable.app would have ranked in the top 50 of the list), but less traffic than their builder-face sites.

这些平台也推动了其他人工智能产品的使用。通过 Replit 和 Lovable(无需自定义域名)构建和发布的网站分别出现在 replit.app 和 lovable.app 的流量中。这两个网站本身都有相当可观的流量(lovable.app 的流量本来可以排进榜单前 50 名),但流量远不及它们的构建器网站。

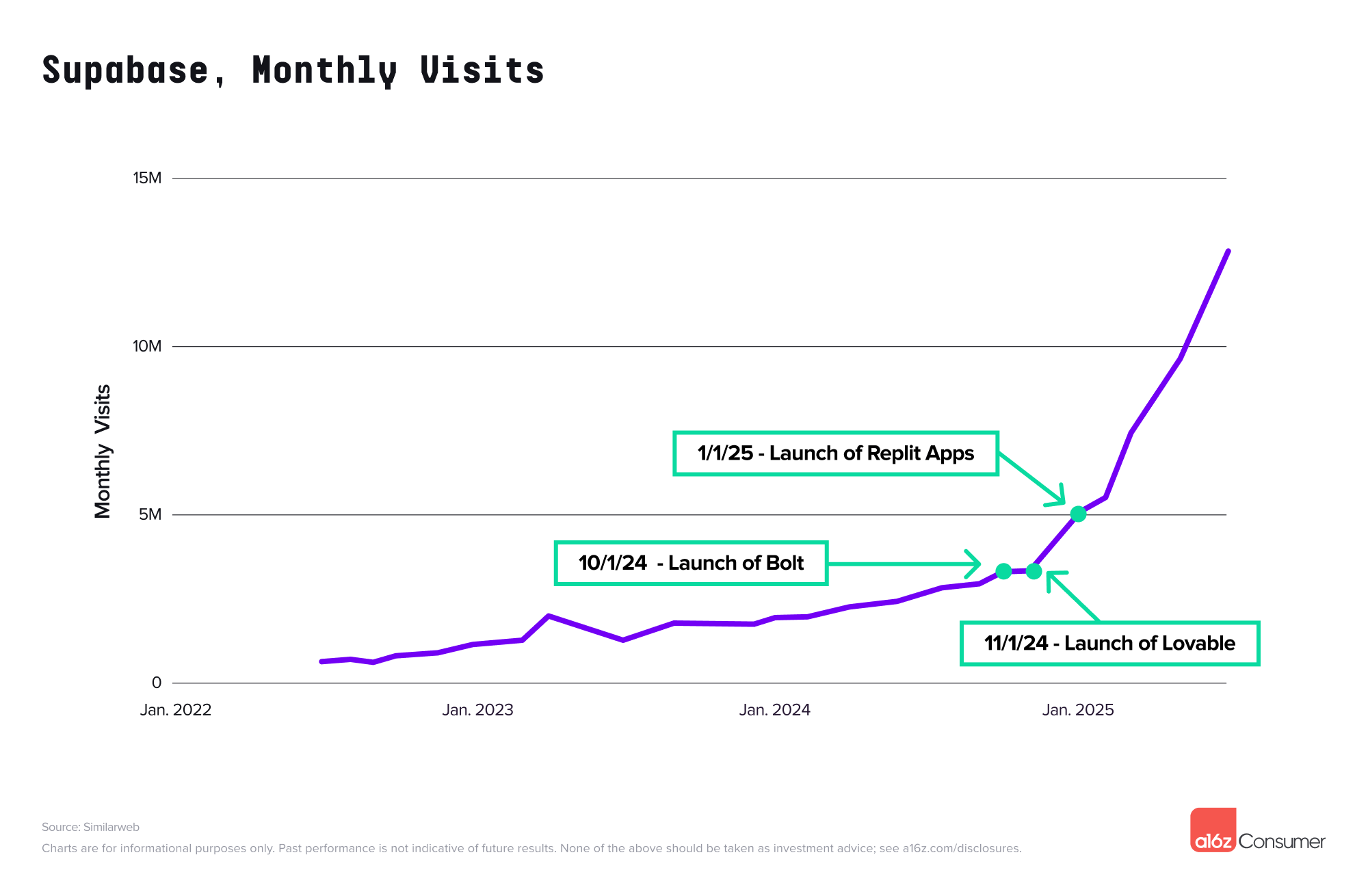

Products that are part of the “vibe coding stack” are also seeing jumps in traffic, as vibe coders adopt them to push their projects live. These are not eligible for the list (as they are not AI-native companies themselves)—the canonical example is Supabase, a database provider. Supabase’s traffic has been in near-lockstep with the rise of core vibe coding platforms, with a significant acceleration over the past nine months as compared to the years prior.

随着氛围编程人员采用“氛围编程栈”中的产品来推动项目上线,这些产品的流量也在激增。这些产品不符合榜单的资格(因为它们本身并非 AI 原生公司)——典型的例子是数据库提供商 Supabase。Supabase 的流量几乎与核心氛围编程平台的兴起同步增长,与前几年相比,过去九个月的流量增长显著加快。

We see real room left for growth and new products within vibe coding—for more, read Batteries Included, Opinions Required: The Specialization of App Gen Platforms

我们看到,氛围编码领域确实存在增长空间和新产品。更多信息,请阅读《 电池已装好,需要意见:应用生成平台的专业化》.

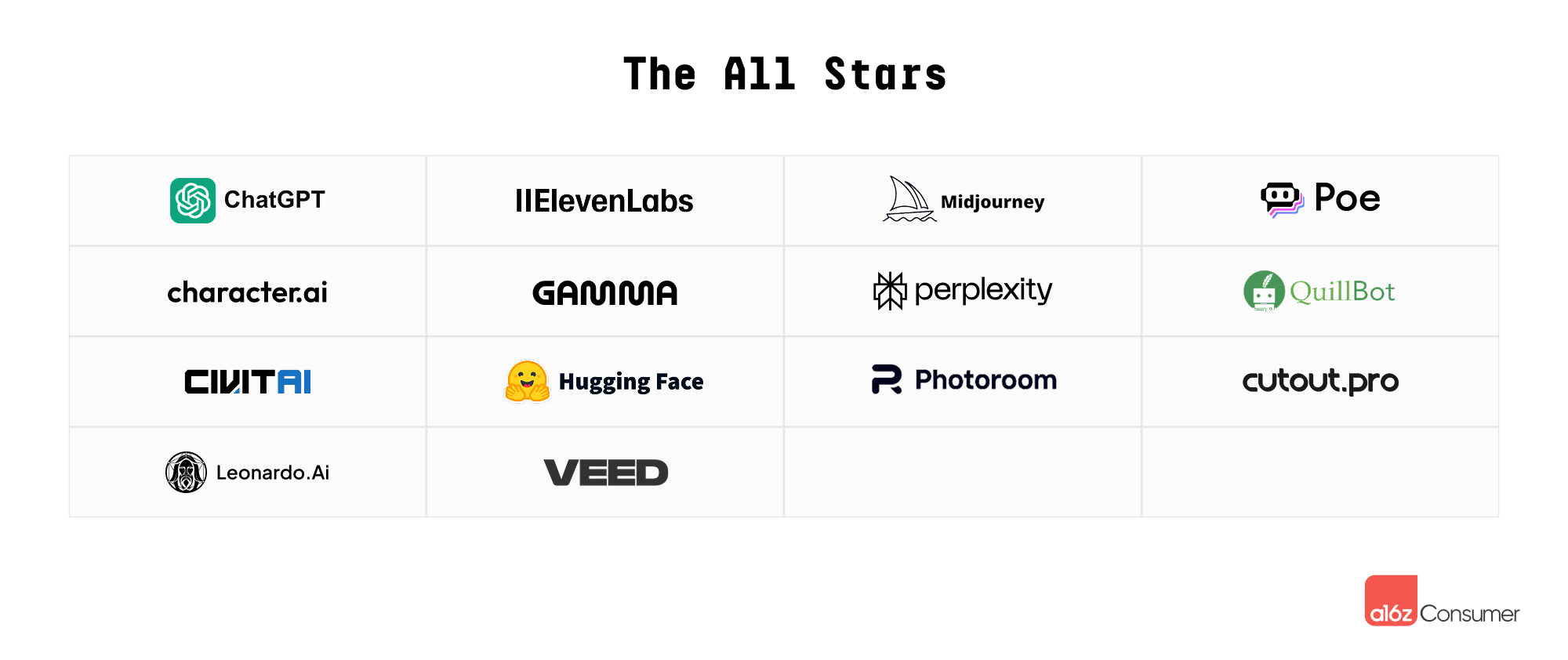

In our five iterations of the web top 50, fourteen companies have appeared every time – we call them the “All Stars”!

在我们五次评选网络 50 强企业中,每次都有 14 家公司上榜——我们称它们为“全明星”!

These companies represent a true cross section of consumer behavior with AI—general assistance (ChatGPT, Perplexity, Poe); companionship (Character AI); image generation (Midjourney, Leonardo); image and video editing (Veed, Cutout); voice generation (Eleven Labs); productivity tools (Photoroom, Gamma, Quillbot); and model hosting (Civitai, HuggingFace).

这些公司代表了人工智能消费者行为的真正横截面——一般协助(ChatGPT、Perplexity、Poe);陪伴(Character AI);图像生成(Midjourney、Leonardo);图像和视频编辑(Veed、Cutout);语音生成(Eleven Labs);生产力工具(Photoroom、Gamma、Quillbot);以及模型托管(Civitai、HuggingFace)。

In our first list (published almost two years ago!), we wondered whether all leading AI consumer companies would train their own foundation models. Now, we have an answer—of the fourteen All Stars, five have proprietary models, while seven utilize API-available or open source models from other companies, and two are model aggregators.

在我们第一份榜单(发布于近两年前!)中,我们曾思考,所有领先的 AI 消费公司是否都会训练自己的基础模型。现在,我们终于找到了答案——十四家全明星公司中,五家拥有专有模型,七家使用其他公司提供的 API 或开源模型,还有两家是模型聚合商。

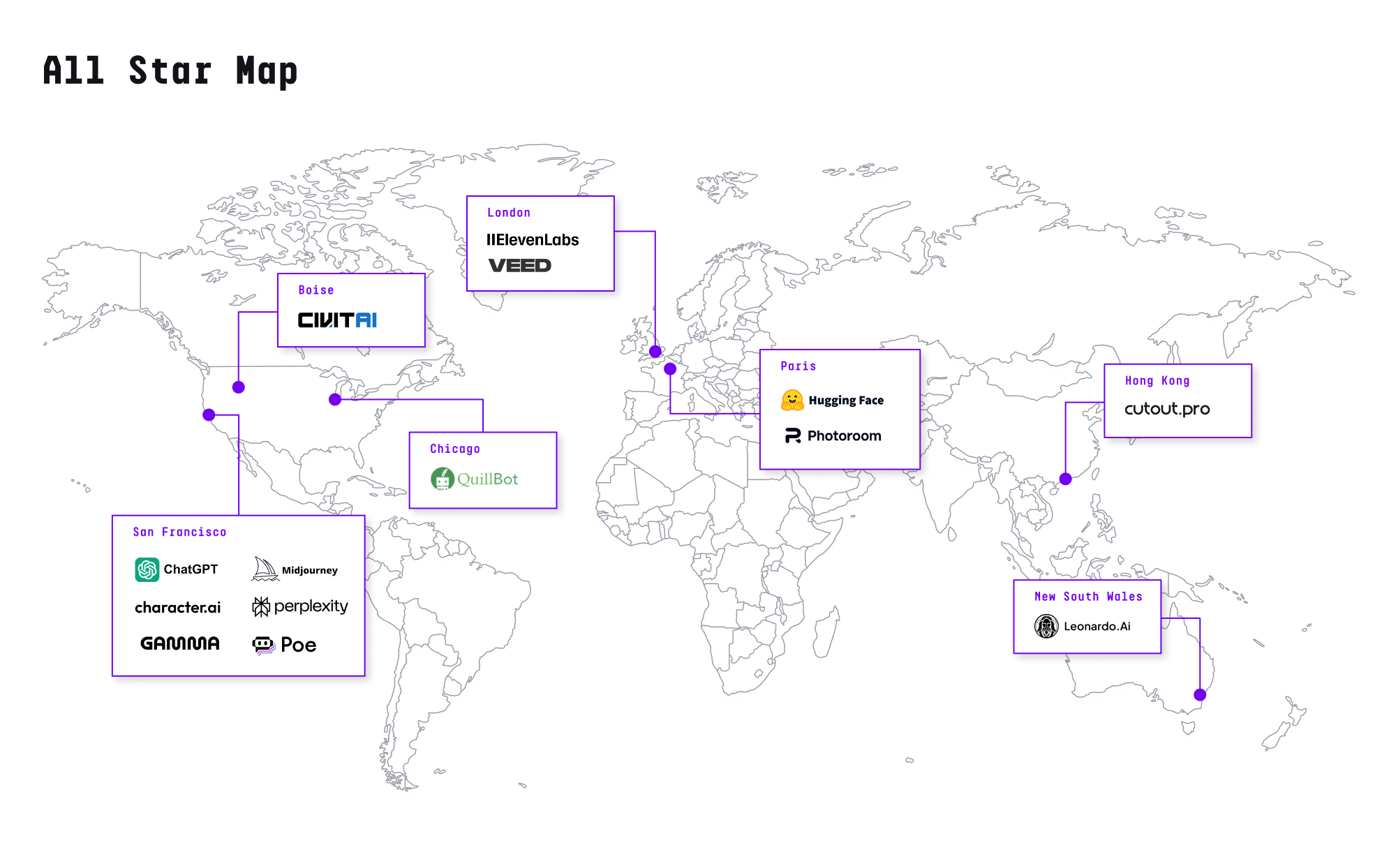

Interestingly, despite the list’s increasingly global scope, all fourteen consistent listmakers come from just five countries: the U.S., the UK (Eleven Labs, Veed), Australia (Leonardo); China (Cutout Pro); and France (Photoroom, HuggingFace). And, all but two have now raised venture funding—Midjourney is famously bootstrapped, and Cutout Pro has also not fundraised.

有趣的是,尽管榜单的覆盖范围日益全球化,但所有十四家常年上榜的公司都来自五个国家:美国、英国(Eleven Labs、Veed)、澳大利亚(Leonardo)、中国(Cutout Pro)和法国(Photoroom、HuggingFace)。此外,除两家公司外,其余均已获得风险投资——Midjourney 以白手起家而闻名,而 Cutout Pro 也尚未获得融资。

Excluding the very first list, an additional five companies would make the cut—reflecting their recent momentum. These similarly represent a variety of AI consumer applications, including: Claude and DeepAI (general assistance), JanitorAI (companionship), Pixelcut (image editing), and Suno (music generation).

除去第一榜单,另有五家公司入选,体现了它们近期的强劲势头。这些公司同样代表了各种 AI 消费应用,包括:Claude 和 DeepAI(通用辅助)、JanitorAI(陪伴)、Pixelcut(图像编辑)和 Suno(音乐生成)。